How does Semiconductor Shortage Affect the Automotive Industry?

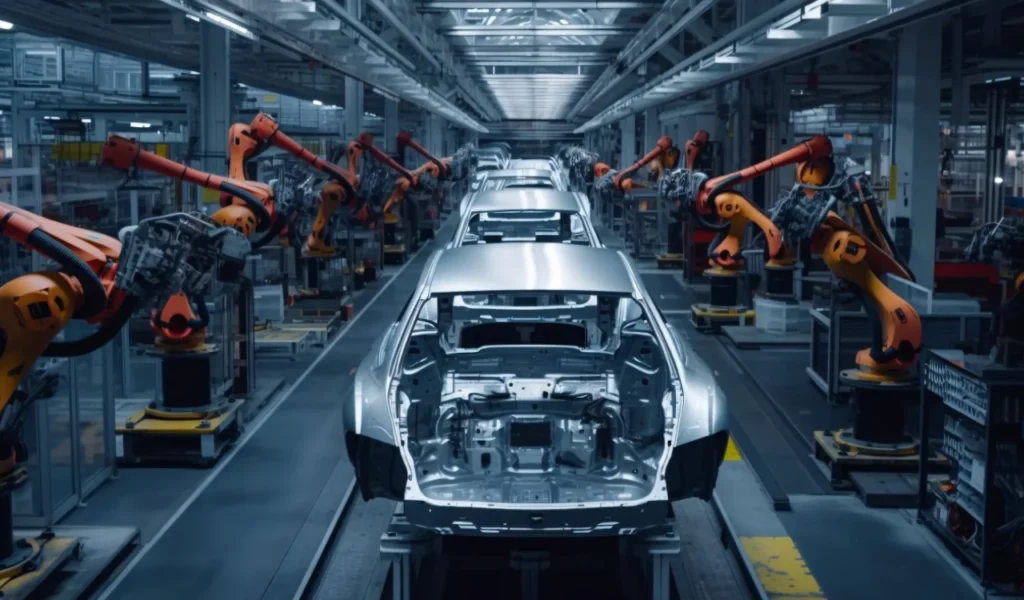

The automotive industry has been confronted with a formidable challenge: the semiconductor shortage. This scarcity of essential electronic components has now echoed throughout the automotive supply chain, causing disruptions and delays on an unprecedented scale. From production halts to reduced vehicle inventories and altered consumer experiences, the ramifications of this shortage are profound since the first-half of 2020, automakers had to deal with introduction schedules and huge revenue losses.

Read More: Explore the Potential, Benefits, and Challenges of Implementing AI

Experts now have a better understanding of both the causes and effects of chip scarcity thanks to emerging data. Mckinsey’s analysis based on a range of macroeconomic assumptions suggests the industry’s aggregate annual growth could average from 6 to 8 percent a year up to 2030. This blog delves into the intricate dynamics of semiconductor shortage, and its profound implications on the automotive landscape.

Understanding the Semiconductor Shortage

At the heart of modern vehicles lies a complex network of electronic systems and components, all of which rely on semiconductors for their functionality. These semiconductors, often referred to as chips, serve crucial roles in everything from engine management and safety systems to infotainment and driver assistance features. However, the demand for semiconductors has surged in recent years, driven by trends such as the growth of electric vehicles (EVs), increasing connectivity, and the rise of autonomous driving technologies. Several factors have converged to create the semiconductor shortage gripping the automotive industry.

- The COVID-19 pandemic disrupted global supply chains, leading to factory closures and logistical challenges.

- Concurrently, the sudden surge in demand for consumer electronics, as people adapted to remote work and digital lifestyles, further strained semiconductor manufacturing capacity.

- Compounding these issues are geopolitical tensions between the US-China and Japan-Korea and natural disasters, such as the recent earthquakes in Japan and Taiwan, which have disrupted semiconductor production.

Read More: Learn How AI is Transforming Automotive Supply Chains with Smart Logistics

Let us look at a few of the major events that caused the semiconductor shortage:

- Renesas Naka factory in Japan faced an earthquake and a building fire consecutively in the months of February and March in 2021.

- In February of 2021, the Texas winter storm Uri caused widespread power outages and rolling blackouts disrupting the chip supply chain.

- An ABF shortage was exacerbated after a fire impacted production for Japanese manufacturer Nittobo in July 2020.

- A fire broke out at the Asahi Kasei Microdevices (AKM) semiconductor plant in Miyazaki, Japan, in October 2020, that left the factory severely damaged and out of operation.

Read More: How AI is Powering Hyper-Personalization and Growth in the Automotive Industry

Global chip shortage analysis 2018 to 2021.

Source: Fusion Worldwide

More Than a Supply Chain Problem

As the automotive sector embraces new electronic architectures, this shift entails a growing utilization of cutting-edge and sophisticated logic chips within automobiles, thereby elevating the significance of advanced semiconductor technologies and their producers in the value chain. The semiconductor shortage has forced automakers to scale back production or even temporarily halt assembly lines, resulting in significant delays and lost revenue. The rise in focus on bringing new electric models into the market has also pushed the demand for these chips to a new height. With semiconductors in short supply, manufacturers are unable to meet consumer demand for new vehicles, leading to depleted inventories at dealerships worldwide. Moreover, the complexity of automotive supply chains means that disruptions at one stage can have cascading effects, impacting suppliers, subcontractors, and ultimately the end consumer.

Just-in-time (JIT) manufacturing has become the standard way of operating for automotive industries. This practice attempts to practice produce-to-demand, essentially manufacturing products that have been pre-ordered only. For automakers, this strategy would have worked well if there were no significant disruptions to the supply chain. However, once the pandemic forced the closure of industries and shipping hubs worldwide, businesses were left without a strong reserve supply to fall back on. This resulted in disruptions at every stage of the supply chain.

Read More: Supply Chain Realities: Tackling Disruptions and Demands in a Changing World

In General Motors, the production cut came as US chipmaker Qualcomm’s quarterly results missed expectations. Ford lost over 1.3 billion dollars amidst the chip shortage in the first three months of 2022. In September of 2022, Toyota had slashed its worldwide vehicle production by 40 percent. These major automotive companies were forced to cut production and temporarily halt assembly lines due to the scarcity of semiconductor chips. The shortage primarily affected vehicles’ advanced features, such as infotainment systems, driver assistance technologies, and engine management systems, which rely heavily on semiconductor components. The ripple effects of the semiconductor shortage extended beyond production delays, impacting dealership inventories and consumer purchasing experiences. As a result, customers faced longer wait times for vehicle deliveries and limited choices in available models.

The Semiconductor Supply Chain is Changing

According to statistics, the largest semiconductor in the market is Intel, with a market share of 9.1 percent, followed by the second largest, that is Samsung, with 7.5 percent. The automotive industry has gone through significant changes since the onset of the chip shortage. They have understood how critical a reliable supply of semiconductors is and how fragile it could be. Companies have signed contracts with semiconductor suppliers to ensure consistent supply. For instance, General Motors has signed a long-term agreement with Global Foundries to establish the exclusive production capacity of U.S.-produced semiconductor chips. And Bosch said it planned to buy key assets of TSI Semiconductor’s chip production facilities in Roseville, California, and invest 1.5 billion dollars to retool the site to make silicon carbide chips, which can help boost the range of electric vehicles.

Though the supply chain is now resilient, the question lingers: will we face another chip crisis? “Yes,” says Rakesh Kumar. He stated, ‘Chip shortages result from a mismatch between supply and demand that cannot be addressed quickly either by chip manufacturers by scaling up production or by markets by adapting to the chip production profile. The challenge of resolving the two isn’t going away—and may even grow in size.’

The semiconductor shortage has profoundly impacted the automotive industry, revealing vulnerabilities in global supply chains and highlighting the critical role of semiconductors in modern vehicles. As demand for vehicles continues to rise and reliance on semiconductor technology deepens, proactive collaboration among stakeholders, strategic investment in production capacity, and diversification of supply chains will be essential to proactively navigate these complexities.

The automotive industry can mitigate future disruptions and pave the way for sustainable growth and innovation in the digital age. AI (Artificial Intelligence) can assist the automotive industry amidst the semiconductor shortage by optimizing production scheduling, enabling efficient allocation of available semiconductor components to prioritize critical vehicle systems, etc. Additionally, AI can aid in the development of more energy-efficient vehicles and autonomous driving technologies, reducing dependency on traditional semiconductor-intensive systems. Through Syren Cloud’s advanced services you can create an agile, resilient, and sustainable supply chain with our consulting support. Our end-to-end solution covers strategy alignment with your business plan to thorough process optimization.